ny paid family leave tax category

Benefits paid to employees will be taxable non-wage income that must be included in federal gross income Taxes will not automatically be withheld from benefits. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program.

The Average Net Worth By Age For The Upper Middle Class

Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

. Are the premiums paid under the Paid Family Leave program through employee payroll deduction considered remuneration for unemployment insurance purposes. Employees earning less than the Statewide Average Weekly Wage SAWW of 159457 will contribute less than the annual cap of 42371 consistent with their actual wages. Set the appropriate state rates and limits for NY on the State Setup tab under Firm Rates Withholding Setup.

New York has passed legislation that will require all private employers to provide employees with paid family leave. It was recently made part of the W-2 form in 2018 and the employer is required to fill it just as other boxes on the form. SDI is an abbreviation for State Disability Insurance.

Interplay between New York PFL and DBL and the FMLA New York PFL and DBL. Employees can request voluntary tax withholding. After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program.

The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. As PFL premiums are funded through employee payroll deductions the Department has reviewed the tax treatment of these contributions along with. Paid Family Leave provides eligible employees job-protected paid time off to.

New York States Department of Taxation and Finance released guidance regarding the tax implications of New York Paid Family Leave PFL the benefits of which take effect on January 1 2018. The correct category for NYPFL in W-2 box 14 is any one of the following slight variations whichever appears in the list that you are selecting from. The state of New York has a website dedicated to assisting employees employers and healthcare professionals with Paid Family Leave.

What is NY SDI category. Employee eligibility for New York PFL coverage Employees scheduled to work 20 hours or more per week are eligible for PFL after 26 consecutive weeks of employment. Pursuant to the Department of Tax Notice No.

Employers cannot take any other form of retaliation. Francescangeli83 The exact wording is slightly different in different places in TurboTax but they are all the same category. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers. Confirm that the clients state is NY in Client Edit Contact Information. Beginning on January 1 2025 under the Time to Care Act of 2022 paid leave will be available to eligible Maryland employees for family leave medical leave and family military leave.

Tax treatment of family leave contributions and benefits under the New York program. They are however reportable as income for IRS and NYS tax purposes. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371.

The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employeesPaid Family Leave Benefits available to employees as of January 1. N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

Ny paid family leave tax category Monday May 2 2022 Edit. The maximum 2021 annual contribution will be 38534 up from 19672 for 2020. Employees qualify for paid family leave after working 20 or more hours a week for 26 weeks 6 months.

The New York Paid Family Leave Program NYPFL will provide New Yorkers job-protected paid leave to bond with a new child care for a loved one with a serious health condition or help relieve family pressures when someone is called to active military service. The characterization of the premium payment as a state disability insurance tax as instructed by the New York Department of Taxation and Finance is misleading. Employers will be required to purchase a paid family leave insurance policy or self-insure.

Be that employees employers or insurance carriers the NYPFL category raises some questions for many. Assign the NY deduction to employees. Set up the NY paid family leave as a deduction.

This amount is subject to contributions. Based upon this review and consultation we offer the following guidance. June 7 2019 417 PM.

Employers cannot fire or demote employees for taking paid family leave under state law. Paid Family Leave PFL is now available to eligible employees of the City of New York. If you have not previously entered this information these fields display the 000 default.

The premium for the policy will be funded solely by employees through a payroll deduction. However premium for paid family leave is treated as the payment of a New York state tax. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Employers cannot terminate health insurance for employees who take paid family leave. Paid Family Leave may also be available in.

Employees working less than 20 hours per week are eligible after working 175 days. Paid family leave benefits are not treated as disability benefits for any tax purpose.

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

What Income Level Is Considered Rich Financial Samurai

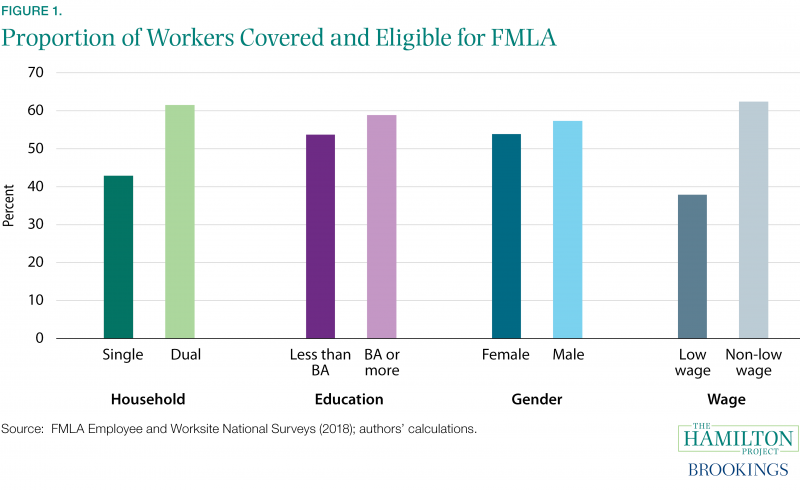

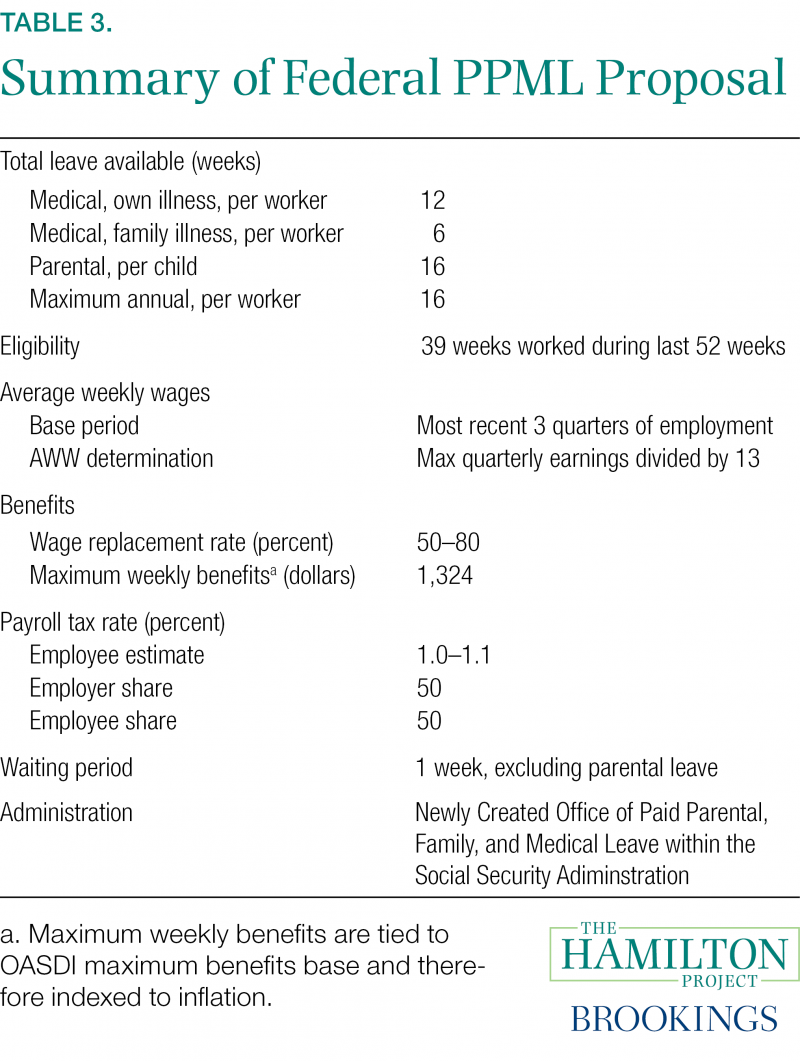

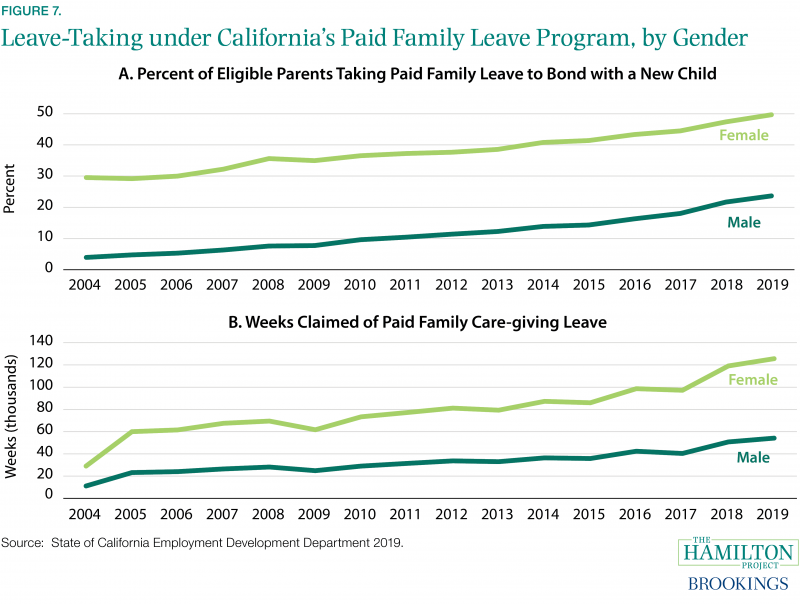

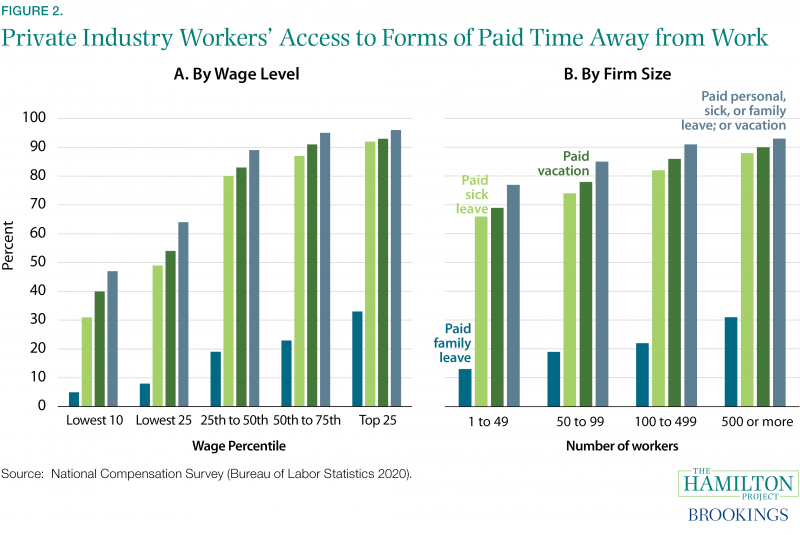

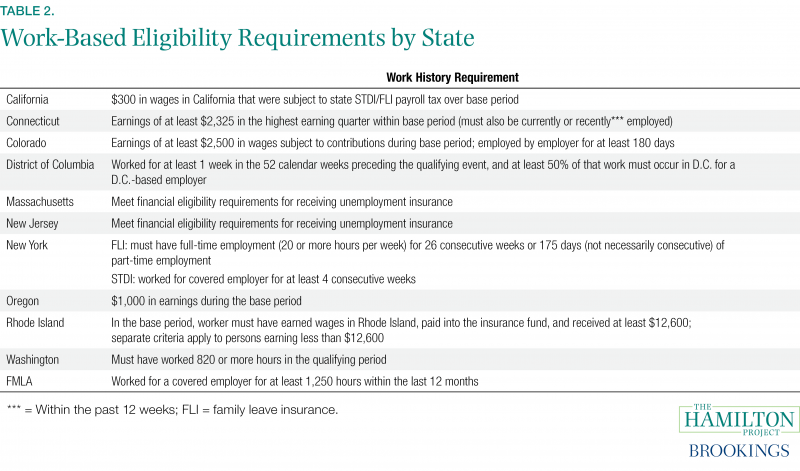

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Paid Family Leave For Family Care Paid Family Leave

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Professional Employers And The Transformation Of Workplace Benefits Yale Journal On Regulation

The Average Net Worth By Age For The Upper Middle Class

What S It Like Making 300 000 A Year Lifestyle And Psychology

Paid Family Leave For Family Care Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave

The 92 Best Small Business Ideas For 2022 By Category Business 2 Community

_800_519.png)

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project